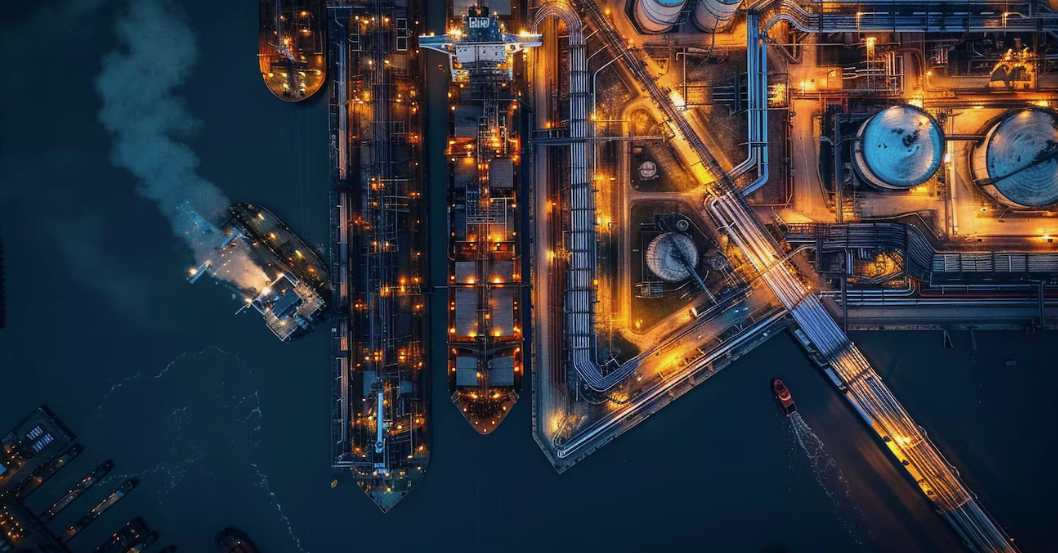

Capital Decisions, Backed by Real-Time Intelligence

Online service delivering total financial control for upstream CFOs

BOOK A DEMO

Forecast Auto-Update Dashboard

From Volatility to Visibility: Turn oil price chaos into forecast clarity and revenue control. Goodbye manual reports. Hello real-time decisions.

What’s Holding CFOs

Back

Inability to predict or control revenue due to oil price volatility

Unexpected spikes in operational expenses disrupt budgets and force reactive changes to investment plans

Constantly reworking forecasts and budgets is costly and time-consuming

Strategic planning gets derailed by sudden global events, price swings, and investor shifts

What 3V.FINNAVIGATOR

Unlocks

Live market feeds automatically flow into revenue models

Forecasts and plans are updated dynamically

Simulates multiple revenue paths instantly as the market shifts

Finance, operations, and strategy teams build forecasts and what-if models together — using the same live data

What CFO Gains

More stable, confident planning even in volatile markets

Less time spent redoing models — more time guiding strategy

Reduced re-forecasting cycles and improved accuracy under volatility

Faster decision-making when the market shifts

Forecast Update Speed:

Up to 5x faster forecast updates

Forecast Accuracy Improvement:

+30–50% increase in forecast accuracy during volatile pricing periods

Time Saved per Forecast Revision:

Avg. 12–20 hours saved per re-forecast cycle

Capital Allocation Modeler

Optimize your capital mix in real time.

Make smarter investment decisions across the entire portfolio.

What’s Holding CFOs

Back

Difficulty securing funding for high-cost projects

Limited financial buffer for innovation or strategic growth

Tough to tell which projects will actually pay off

Walking a tightrope between growth and returns

Slow paybacks lock up capital — and other opportunities are missed

Working capital takes too long to move — slow receivables or inventory tie up cash

What 3V.FINNAVIGATOR

Unlocks

Finds tied-up capital and releases it

Matches project profiles with best-fit funding options

Helps identify non-debt capital or cheaper funding options

Ranks and scores combinations of investments using real-time inputs

Simulator shows how each dollar spent affects growth, shareholder payouts, and credit

Flags low-return or high-lockup investments before capital is committed

Alerts when mix of project ties up too much capital for too long

What CFO Gains

Clear visibility into alternative capital sources’ efficiency

It lets model the impact of higher interest rates before committing

CFO can present a sharper, data-backed investment case

CFO avoids guesswork and risk of backing underperforming projects

Confidence in striking a smart balance

Ease to explain trade-offs to both investors and the CEO

Improves agility when new opportunities pop up

Helps avoid late-stage panic moves like fire sales or bridge loans

Capital Efficiency Gain:

10–20% more capital freed by avoiding low-ROI or slow-payback initiatives

CAPEX Reallocation Rate:

+25–40% more CAPEX directed toward high-return initiatives

Investment Evaluation Speed:

3–6x faster project ranking and capital decision workflows

Variance Analyzer

Full boardroom clarity: Increase trust from stakeholders through transparency and evidence-backed assumptions.

Reframe misses as managed risks, not forecasting failures.

What’s

Holding CFOs

Back

Pressure despite uncontrollable market forces: CFOs are questioned when profits drop, even when it caused by external price shifts

CFOs are often held accountable for poor results driven by external forces like geopolitical events

When numbers fail to match forecasts, CFOs feel exposed—even when the underlying assumptions were valid

What

FINNAVIGATOR

Unlocks

Translates complex data into clear, executive-friendly online monitor

Automatically explains the delta between actual vs. forecasted figures (e.g., pricing, production variances, delays)

Shows what portion of a miss was driven by external factors vs. execution

Ask AI-powered assistant natural-language questions like:“Why did Q2 production miss forecast?”...

The AI-driven assistant generates bulletproof responses with data citations

What CFO Gains

Clear separation of CFO decisions from external impacts

Switch from reactive defensiveness to proactive clarity

When volatility hits, you’ll have the answer — not the apology

Less time defending. More time executing

Time-to-Explain Forecast Deviations:

90% faster variance explanations (from days to minutes)

Unexplained Variance Rate:

Cut by 60–80%

Board-Ready Report Generation Time:

Reduced from 8–12 hours to <1 hour

Solution

Unlike traditional ERP and accounting platforms or production analytics tools, FINNAVIGATOR:

Helps make decisions instantaneous, not lagged

Enables moment-of-change forecasting

Provides more reliable financial planningunder stress

Delivers strategic capital efficiency across all investments

Gives clear audit trail for explaining deviations

Eliminates misalignment and version control issues

The CFO’s Unified Command Center for Upstream Oil & Gas Finance

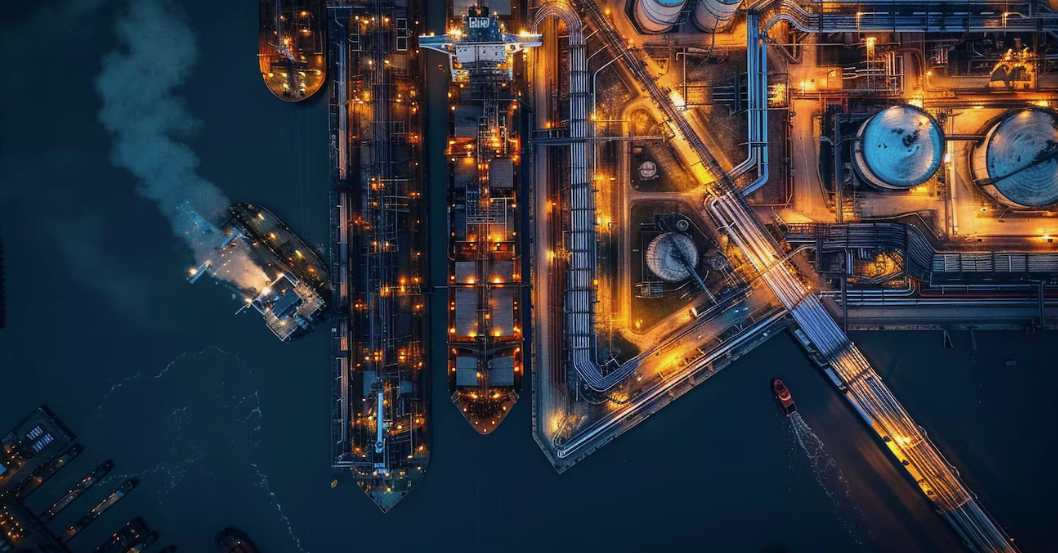

A cloud-native, AI-powered online financial service designed specifically for upstream oil & gas CFOs navigating commodity volatility, rising costs, investor scrutiny, and capital complexity

Seamlessly connect ERP systems (e.g., SAP, Oracle), production platforms, trading desks, and public market data

Reduce manual labor and improve the accuracy of projections

Compare growth plans, capital risks, and shareholder impacts — in one workspace

Finance, operations, and strategy teams can co-edit budget assumptions, capital plans, and scenario inputs

Export board-ready reports, charts, and scenario walkthroughs with audit trails

Auto-ingestion, audit trails, and data validation build trust in the numbers

This isn’t just a finance upgrade.

It’s a strategic CFO weapon built for modern upstream oil & gas dynamics.

Book a Demo

Capital Decisions, Backed by Real-Time Intelligence

Online service delivering total financial control for upstream CFOs

Forecast Auto-Update Dashboard

From Volatility to Visibility: Turn oil price chaos into forecast clarity and revenue control. Goodbye manual reports. Hello real-time decisions.

What’s Holding CFOs

Back

Inability to predict or control revenue due to oil price volatility

Unexpected spikes in operational expenses disrupt budgets and force reactive changes to investment plans

Constantly reworking forecasts and budgets is costly and time-consuming

Strategic planning gets derailed by sudden global events, price swings, and investor shifts

What

FINNAVIGATOR

Unlocks

Live market feeds automatically flow into revenue models

Forecasts and plans are updated dynamically

Simulates multiple revenue paths instantly as the market shifts

Finance, operations, and strategy teams build forecasts and what-if models together — using the same live data

What CFO Gains

More stable, confident planning even in volatile markets

Less time spent redoing models — more time guiding strategy

Reduced re-forecasting cycles and improved accuracy under volatility

Faster decision-making when the market shifts

Forecast Update Speed:

Up to 5x faster forecast updates

Forecast Accuracy Improvement:

+30–50% increase in forecast accuracy during volatile pricing periods

Time Saved per Forecast Revision:

Avg. 12–20 hours saved per re-forecast cycle

Capital Allocation Modeler

Optimize your capital mix in real time.

Make smarter investment decisions across the entire portfolio.

What’s Holding CFOs

Back

Difficulty securing funding for high-cost projects

Limited financial buffer for innovation or strategic growth

Tough to tell which projects will actually pay off

Walking a tightrope between growth and returns

Slow paybacks lock up capital — and other opportunities are missed

Working capital takes too long to move — slow receivables or inventory tie up cash

What

FINNAVIGATOR

Unlocks

Finds tied-up capital and releases it

Matches project profiles with best-fit funding options

Helps identify non-debt capital or cheaper funding options

Ranks and scores combinations of investments using real-time inputs

Simulator shows how each dollar spent affects growth, shareholder payouts, and credit

Flags low-return or high-lockup investments before capital is committed

Alerts when mix of project ties up too much capital for too long

What CFO Gains

Clear visibility into alternative capital sources’ efficiency

It lets model the impact of higher interest rates before committing

CFO can present a sharper, data-backed investment case

CFO avoids guesswork and risk of backing underperforming projects

Confidence in striking a smart balance

Ease to explain trade-offs to both investors and the CEO

Improves agility when new opportunities pop up

Helps avoid late-stage panic moves like fire sales or bridge loans

Capital Efficiency Gain:

10–20% more capital freed by avoiding low-ROI or slow-payback initiatives

CAPEX Reallocation Rate:

+25–40% more CAPEX directed toward high-return initiatives

Investment Evaluation Speed:

3–6x faster project ranking and capital decision workflows

Variance Analyzer

Full boardroom clarity: Increase trust from stakeholders through transparency and evidence-backed assumptions.

Reframe misses as managed risks, not forecasting failures.

What’s

Holding CFOs

Back

Pressure despite uncontrollable market forces: CFOs are questioned when profits drop, even when it caused by external price shifts

CFOs are often held accountable for poor results driven by external forces like geopolitical events

When numbers fail to match forecasts, CFOs feel exposed—even when the underlying assumptions were valid

What

FINNAVIGATOR

Unlocks

Translates complex data into clear, executive-friendly online monitor

Automatically explains the delta between actual vs. forecasted figures (e.g., pricing, production variances, delays)

Shows what portion of a miss was driven by external factors vs. execution

Ask AI-powered assistant natural-language questions like:“Why did Q2 production miss forecast?”...

The AI-driven assistant generates bulletproof responses with data citations

What

CFO

Gains

Clear separation of CFO decisions from external impacts

Switch from reactive defensiveness to proactive clarity

When volatility hits, you’ll have the answer — not the apology

Less time defending. More time executing

Time-to-Explain Forecast Deviations:

90% faster variance explanations (from days to minutes)

Unexplained Variance Rate:

Cut by 60–80%

Board-Ready Report Generation Time:

Reduced from 8–12 hours to <1 hour

Solution

Unlike traditional ERP and accounting platforms or production analytics tools, FINNAVIGATOR:

Helps make decisions instantaneous, not lagged

Enables moment-of-change forecasting

Provides more reliable financial planning under stress

Delivers strategic capital efficiency across all investments

Gives clear audit trail for explaining deviations

Eliminates misalignment and version control issues

The CFO’s Unified Command Center for Upstream Oil & Gas Finance

A cloud-native, AI-powered online financial service designed specifically for upstream oil & gas CFOs navigating commodity volatility, rising costs, investor scrutiny, and capital complexity

Seamlessly connect ERP systems (e.g., SAP, Oracle), production platforms, trading desks, and public market data

Reduce manual labor and improve the accuracy of projections

Compare growth plans, capital risks, and shareholder impacts — in one workspace

Finance, operations, and strategy teams can co-edit budget assumptions, capital plans, and scenario inputs

Export board-ready reports, charts, and scenario walkthroughs with audit trails

Auto-ingestion, audit trails, and data validation build trust in the numbers

This isn’t just a finance upgrade.

It’s a strategic CFO weapon built for modern upstream oil & gas dynamics.

Book a Demo

Capital Decisions, Backed by Real-Time Intelligence

Online service delivering total financial control for upstream CFOs

Forecast Auto-Update Dashboard

From Volatility to Visibility: Turn oil price chaos into forecast clarity and revenue control. Goodbye manual reports. Hello real-time decisions.

What’s Holding CFOs

Back

Inability to predict or control revenue due to oil price volatility

Unexpected spikes in operational expenses disrupt budgets and force reactive changes to investment plans

Constantly reworking forecasts and budgets is costly and time-consuming

Strategic planning gets derailed by sudden global events, price swings, and investor shifts

What

FINNAVIGATOR

Unlocks

Live market feeds automatically flow into revenue models

Forecasts and plans are updated dynamically

Simulates multiple revenue paths instantly as the market shifts

Finance, operations, and strategy teams build forecasts and what-if models together — using the same live data

What CFO Gains

More stable, confident planning even in volatile markets

Less time spent redoing models — more time guiding strategy

Reduced re-forecasting cycles and improved accuracy under volatility

Faster decision-making when the market shifts

Forecast Update Speed:

Up to 5x faster forecast updates

Forecast Update Speed:

+30–50% increase in forecast accuracy during volatile pricing periods

Time Saved per Forecast Revision:

Avg. 12–20 hours saved per re-forecast cycle

Capital Allocation Modeler

Optimize your capital mix in real time.

Make smarter investment decisions across the entire portfolio.

What’s Holding CFOs

Back

Difficulty securing funding for high-cost projects

Limited financial buffer for innovation or strategic growth

Tough to tell which projects will actually pay off

Walking a tightrope between growth and returns

Slow paybacks lock up capital — and other opportunities are missed

Working capital takes too long to move — slow receivables or inventory tie up cash

What

FINNAVIGATOR

Unlocks

Finds tied-up capital and releases it

Matches project profiles with best-fit funding options

Helps identify non-debt capital or cheaper funding options

Ranks and scores combinations of investments using real-time inputs

Simulator shows how each dollar spent affects growth, shareholder payouts, and credit

Flags low-return or high-lockup investments before capital is committed

Alerts when mix of project ties up too much capital for too long

What CFO Gains

Clear visibility into alternative capital sources’ efficiency

It lets model the impact of higher interest rates before committing

CFO can present a sharper, data-backed investment case

CFO avoids guesswork and risk of backing underperforming projects

Confidence in striking a smart balance

Ease to explain trade-offs to both investors and the CEO

Improves agility when new opportunities pop up

Helps avoid late-stage panic moves like fire sales or bridge loans

Capital Efficiency Gain:

10–20% more capital freed by avoiding low-ROI or slow-payback initiatives

CAPEX Reallocation Rate:

+25–40% more CAPEX directed toward high-return initiatives

Investment Evaluation Speed:

3–6x faster project ranking and capital decision workflows

Variance Analyzer

Full boardroom clarity: Increase trust from stakeholders through transparency and evidence-backed assumptions.

Reframe misses as managed risks, not forecasting failures.

What’s

Holding CFOs

Back

Pressure despite uncontrollable market forces: CFOs are questioned when profits drop, even when it caused by external price shifts

CFOs are often held accountable for poor results driven by external forces like geopolitical events

When numbers fail to match forecasts, CFOs feel exposed—even when the underlying assumptions were valid

What

FINNAVIGATOR

Unlocks

Translates complex data into clear, executive-friendly online monitor

Automatically explains the delta between actual vs. forecasted figures (e.g., pricing, production variances, delays)

Shows what portion of a miss was driven by external factors vs. execution

Ask AI-powered assistant natural-language questions like:“Why did Q2 production miss forecast?”...

The AI-driven assistant generates bulletproof responses with data citations

What

CFO

Gains

Clear separation of CFO decisions from external impacts

Switch from reactive defensiveness to proactive clarity

When volatility hits, you’ll have the answer — not the apology

Less time defending. More time executing

Time-to-Explain Forecast Deviations:

90% faster variance explanations (from days to minutes)

Unexplained Variance Rate:

Cut by 60–80%

Board-Ready Report Generation Time:

Reduced from 8–12 hours to <1 hour

Solution

Unlike traditional ERP and accounting platforms or production analytics tools, FINNAVIGATOR:

Helps make decisions instantaneous, not lagged

Enables moment-of-change forecasting

Provides more reliable financial planningunder stress

Delivers strategic capital efficiency across all investments

Gives clear audit trail for explaining deviations

Eliminates misalignment and version control issues

The CFO’s Unified Command Center for Upstream Oil & Gas Finance

A cloud-native, AI-powered online financial service designed specifically for upstream oil & gas CFOs navigating commodity volatility, rising costs, investor scrutiny, and capital complexity

Seamlessly connect ERP systems (e.g., SAP, Oracle), production platforms, trading desks, and public market data

Reduce manual labor and improve the accuracy of projections

Compare growth plans, capital risks, and shareholder impacts — in one workspace

Finance, operations, and strategy teams can co-edit budget assumptions, capital plans, and scenario inputs

Export board-ready reports, charts, and scenario walkthroughs with audit trails

Auto-ingestion, audit trails, and data validation build trust in the numbers

This isn’t just a finance upgrade.

It’s a strategic CFO weapon built for modern upstream oil & gas dynamics.

Book a Demo